Blog posts

Featured Posts

Budgeting & Lifestyle

-

Financial Resources Nationwide: Tools for Smart...

Key Highlights Discover how effective budgeting tools can help you manage your cash flow and achieve your financial goals. Learn smart investment strategies to reduce market risk and handle market...

Financial Resources Nationwide: Tools for Smart...

Key Highlights Discover how effective budgeting tools can help you manage your cash flow and achieve your financial goals. Learn smart investment strategies to reduce market risk and handle market...

-

Understanding the importance of the Profit and ...

Key Highlights A Profit and Loss (P&L) statement, also known as an income statement, tracks revenue, expenses, and profit during a specific period. It helps business owners understand their company’s...

Understanding the importance of the Profit and ...

Key Highlights A Profit and Loss (P&L) statement, also known as an income statement, tracks revenue, expenses, and profit during a specific period. It helps business owners understand their company’s...

-

Why Financial Literacy is important for Entrepr...

Key Highlights Financial literacy empowers entrepreneurs to make informed financial decisions, ensuring business success. Understanding cash flow, budgeting, debt management, and investments adds stability to business operations. A strong foundation...

Why Financial Literacy is important for Entrepr...

Key Highlights Financial literacy empowers entrepreneurs to make informed financial decisions, ensuring business success. Understanding cash flow, budgeting, debt management, and investments adds stability to business operations. A strong foundation...

-

The Importance of Financial Literacy for Young ...

Key Highlights Financial literacy is crucial for young adults to make informed financial decisions. Understanding budgeting, saving, credit, and debt management are essential components. Utilizing financial planning apps and resources...

The Importance of Financial Literacy for Young ...

Key Highlights Financial literacy is crucial for young adults to make informed financial decisions. Understanding budgeting, saving, credit, and debt management are essential components. Utilizing financial planning apps and resources...

-

How to Catch Up if You’re Late to Save for Reti...

Need to catch up on saving for retirement? You’re not alone. Many people find themselves in their 40s, 50s, or even 60s thinking, “Have I saved enough for the future?”...

How to Catch Up if You’re Late to Save for Reti...

Need to catch up on saving for retirement? You’re not alone. Many people find themselves in their 40s, 50s, or even 60s thinking, “Have I saved enough for the future?”...

-

The Importance of Balance: Why You Should Spend...

Most people dream of financial freedom — a life where money is never an obstacle to living how they desire. But here’s the question: how do you get there? The...

The Importance of Balance: Why You Should Spend...

Most people dream of financial freedom — a life where money is never an obstacle to living how they desire. But here’s the question: how do you get there? The...

Investing

-

How Inflation Impacts Your Finances and Ways to...

Inflation is an unavoidable part of our economy. It’s the silent force that makes your morning coffee a little more expensive every year and eats away at your salary’s purchasing...

How Inflation Impacts Your Finances and Ways to...

Inflation is an unavoidable part of our economy. It’s the silent force that makes your morning coffee a little more expensive every year and eats away at your salary’s purchasing...

-

Active vs. Passive Investing: The Pros and Cons...

When it comes to investing, one of the most significant decisions you'll face is whether to take an active or passive approach. Both strategies offer unique benefits and come with...

Active vs. Passive Investing: The Pros and Cons...

When it comes to investing, one of the most significant decisions you'll face is whether to take an active or passive approach. Both strategies offer unique benefits and come with...

-

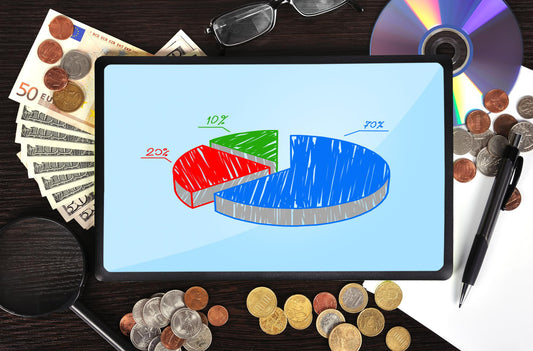

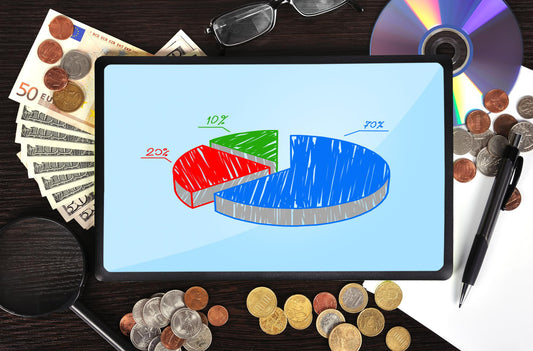

Diversification Explained: How to Reduce Risk i...

Investing can feel like navigating a maze. One wrong turn could lead to losses, while a calculated move might unlock financial rewards. At the heart of a successful investment strategy...

Diversification Explained: How to Reduce Risk i...

Investing can feel like navigating a maze. One wrong turn could lead to losses, while a calculated move might unlock financial rewards. At the heart of a successful investment strategy...